Nope, this isn’t some catchy clickbait youtube title. I legitimately bought a house using American Express.

For me, AmEx has always been a cool brand. I remember reading stories like a guy proposed to his other half on his yacht out at sea, he then wanted to give her some flowers, so he rang AmEx and they organised a bunch of flowers to be delivered to them on their yacht… in the ocean… Or hearing about people waxing a couple hundred Mil at Christie’s on Art and paying using their AmEx.

As I say, AmEx to me has a very strong brand presence and somewhat of an allure.

Starting My AmEx Journey With The BA Card

The first AmEx I got was the British Airways Premium one. I got it for the sole purpose of collecting Avios and the 2-4-1 Voucher. I’m going to say I was about 19 at the time, they decided to set me up with a £10,000 line of credit. It was awesome, 1.5 Avios for every £1 spent then 3 Avios for every £1 spent on BA and it came with a decent signup bonus of I’m going to say 25,000 Avios if you spent £3,000 in the first 3 months. It was awesome to see my BA account Avios balance increase every month.

It wasn’t long before I’d spent my first £10,000 on the card thus earning the AmEx 2-4-1 Voucher, where you and another person could fly using Avios with BA and you would only need half the amount of Avios. Fast forward a few years and after having earned a few 2-4-1 vouchers it started to become apparent how poor the vouchers were.

Availability for places you actually wanted to go was poor, to the point where you’d need to ring up 365 days in advance at midnight to try your best to secure 2 seats (Which I did many times, it’s even worse when the clocks change as you have to wait up until 01:00). You still had to cover the Taxes and BA’s surcharge. The taxes were fine as I’d elect to fly from Inverness as there’s no air passenger duty, so you save about £180 per passenger (The drive to INV is the same distance as LHR but you get to drive through beautiful landscapes). It was British Airway’s Surcharge which was the piss-take, essentially the price you have to pay to use Avios. Currently, if you want to fly long haul, you’ll be paying at least £550 each in surcharges alone, and that’s money that goes straight to BA, no one else.

Onto The Gold Card

After referring a few people for different AmEx’ and getting the referral bonuses, I referred myself for the Gold Card. The signup bonus was probably 15-20,000 Membership Reward points when spending £3,000 in the first 3 months. The reason for the switch was I wanted to gain points that I could use for many things, not just Avios.

I’m a pretty impatient guy, to the point where I’ve ordered Mac Book Pro’s before and it said it would take over a week for delivery so I’ve just cancelled the orders there and then. When I want something, I want it now and when I pay for something I like the satisfaction of receiving said item I’ve purchased.

I instructed my solicitors they had 1 week to complete the purchase of this specific house and that they’d be compensated appropriately. Needless to say, it was done in a week and I signed the papers whilst in the Cathay Pacific Business Class Lounge at Hong Kong airport. When I landed back in the UK I had to make the trip to the solicitors to make payment. This is where I ballsed up.

Excitement got the better of me, and I left money on the table. You see I was doing something which was frowned upon, but not illegal (I don’t think). My line of Credit with AmEx was, well we shall say “Healthy” but it still wasn’t enough to buy the house. After a lengthy call, AmEx wasn’t willing to extend my line of credit so I performed a bit of a hack. I pre-loaded my AmEx by transferring a heap of money to it. That way, I had my full line of credit + the chunk of money I’d just transferred to the account.

Now I know AmEx are pretty hot on this so I only had a few hours to make the payment using my card. I walked into the solicitors and the receptionist (Bless her cotton socks) asked how I’d like to pay. With a slight tone of arrogance and plenty of confidence I responded with “by card”. I wasn’t going to say “Is it okay to make this absolutely huge transaction by card, specifically American Express which you may not actually accept and if you do chances are it’s going to cost you a lot of money to accept it”. Based on life experience, if you do something with confidence, nobody questions it.

I Wasn’t Lying When I Said I Bought A House Using My AmEx

That was that. A tiny card machine printed out a receipt and the house was paid for. I waited for days, then weeks for the solicitors to get in touch with me to say they were reversing the transaction. Same with American Express, for them to say I had breached their rules. NOTHING. I mean i did pay the full balance of the card ass soon as it showed up but still, i thought they’d have said/done something.

The Money Left On The Table

I mentioned earlier that I left money on the table, and this is 100% the case. Using my AmEx Gold Card I only got 1MR point per £1 spent, if I had used my BA AmEx I’d have had 1.5 Avios per £1 spent. Yes, it’s a fairly large chunk of points but my main priority was seeing if I could actually buy a house using an AmEx.

The Outcome

Despite the obvious of adding a house to the collection, I flew me and my girl out to Mexico in First Class to sit on a swinging seat on the beach as the sun set (As well as a whole bunch of other stuff) for nothing. Yes, it wasn’t the balls-to-the-wall fly First Class to The Maldives and stay in either The Ritz Carlton or JW Marriott in Over Water Villas that I had booked originally which would have run you £20,000 (Cheers COVID) but it was still 1 hell of an experience. I mean my girl was sat in 1A on the 11-hour flight home with Clive Owen sat in 2A.

And Now

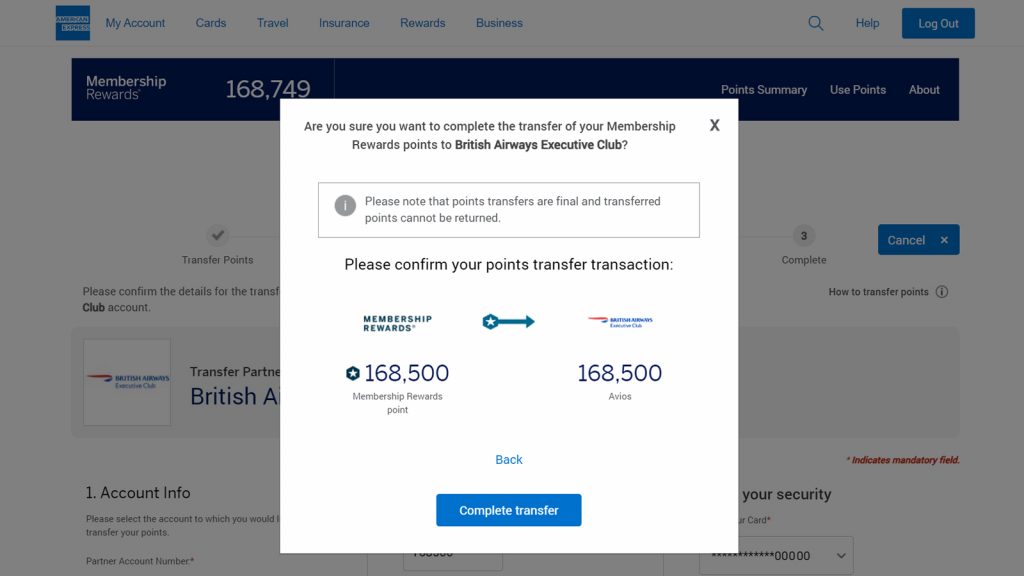

Well, I’ve just transferred the last of my balance, 168,500 Membership Reward Points to my British Airways Executive Club account and will be closing the account down (You can see how easy that process is here). I’m pretty cheesed off with AmEx so I think it’s time to part ways for now.

The first thing which pissed me off massively was the 100+ hours of time i had to invest trying to chase down chargebacks. Pre wuflu AmEx customer service was quality, you ring up and they sort it. During Covid, however, the wheels fell off the kart. One instance, Using an online travel agent I booked several 4 figure business-class tickets to China for May 2020… ‘Rona hit and ALL travel agents batten down the hatches. It was probably easier getting in touch with Binladen. I raised 4 chargebacks through American Express, all of which failed stating something along the line of ‘I need to contact the company I purchased the tickets through’ – No shit sherlock, do you honestly think I’d be contacting you if I had an open line of communication with them?!?!!?!??!

Back and forth with AmEx and I kid you not I tallied all the calls up over the period of 19 months, over 100 hours on the photo to American Express. The outcome I hear you ask? they successfully got 3 of the 4 transactions refunded to me but the 4th wasn’t possible. The kicker to all of this. They were all the exact same tickets just on different dates… So their back office staff cost me a few grand because they were lazy. I asked them to complete a Section 75 for the last one with all the information I had provided, but it wasn’t done. I asked them to provide me with every document I had sent to them, it wasn’t done.

The UK Gets Screwed Over

The nail in the coffin, I was sick to death of seeing transfer bonuses for every part of the world except The UK. In the last 6 months, there have been many offers for Americans to transfer their points to other programs with bonuses, things like:

- Transfer Amex points to Aer Lingus AerClub with a 25% bonus

- Transfer Amex points to Aeromexico Club Premier with a 20% bonus

- Transfer Amex points to Air Canada Aeroplan with a 15% bonus

- Transfer Amex points to Air France-KLM Flying Blue with a 25% bonus

- Transfer Amex points to Avianca LifeMiles with a 15% bonus

- Transfer Amex points to British Airways Executive Club with a 25% bonus

- Transfer Amex points to Choice Privileges with a 25% bonus

- Transfer Amex points to Hawaiian Airlines HawaiianMiles with a 20% bonus

- Transfer Amex points to Hilton Honors with a 30% bonus

- Transfer Amex points to Marriott Bonvoy with a 20% bonus

- Transfer Amex points to Qantas Frequent Flyer with a 20% bonus

- Transfer Amex points to Virgin Atlantic Flying Club with a 30% bonus

For almost 2 years I have waited and waited for a transfer bonus promotion to appear on my account, NOTHING!!!

Saving Grace

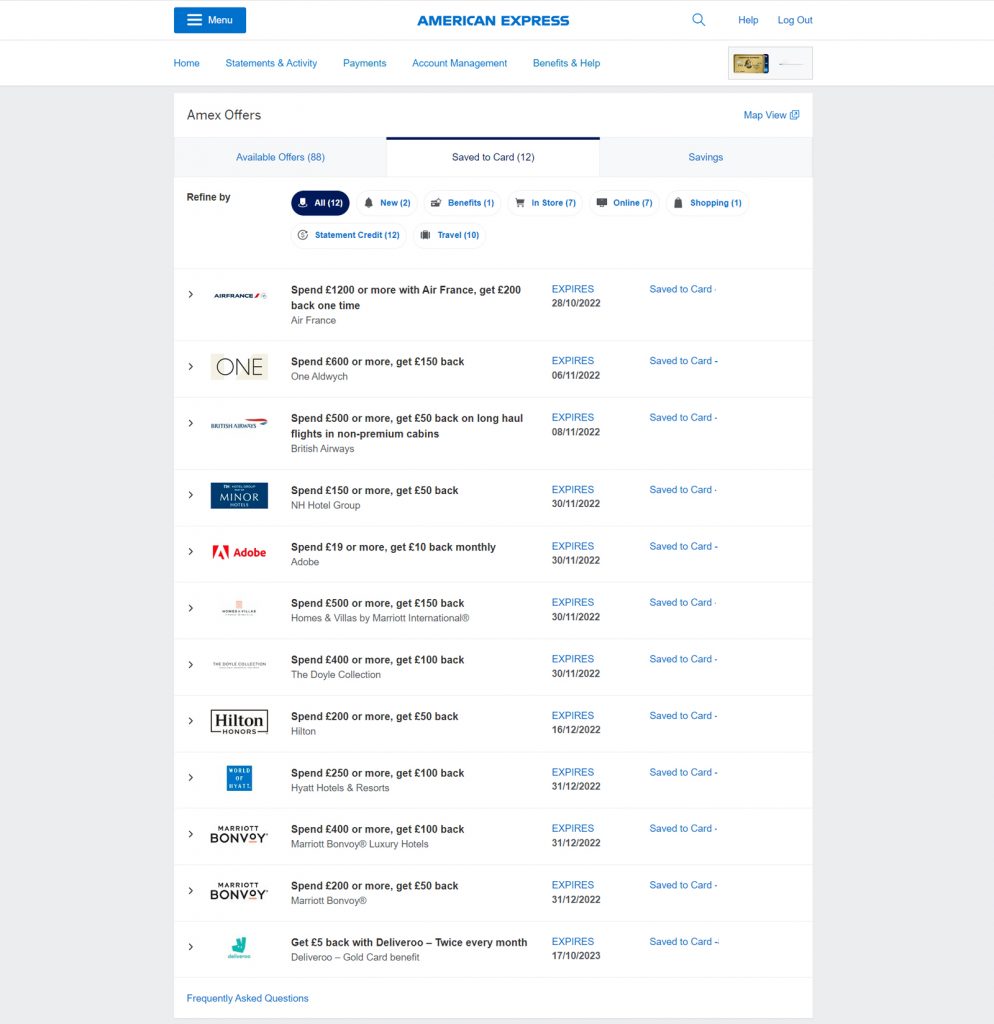

It has to be the offers they have for card members, Above is what’s currently saved to my card. There’s about a grand worth of saving to be had but that’s on very specific spending. For the majority of people, this is one of the key benefits of the card. I’m sort of past that point at the moment. I have a HUGE stash of different points so I’m not looking to spend any money at the moment, I just want to cash those points in and have a bit of fun for free.

Take Aways

If you’ve made it to this point, you can clearly see I try and maximise everything I do. Not only was there no mortgage or interest involved, I got rewarded handsomely for my craftiness. I bang on about points a lot but surely this post points out the possibilities are endless?