If ever there was a credit card which was perfect for someone new in the points collecting game, it would be the gold card from AmEx. With points on purchases and different offers throughout the year, it’s a nice card to have. This will be a fairly lengthy post as it’s about finance and I want to give as much info as possible to hopefully help.

Read First!

If you’re the kind of person who’s only credit cards are those with 0% on spending or balance transfers, I don’t think this is the card for you. You should be able to pay the card off in full every month, if not the interest rates are like 20%+ and it will cost you more in interest than the points you will get. Seriously, it’s not worth getting into debt for points. I’m a strong advocate of living within your means, and again don’t recommend this card for anyone not able to pay off what they spend either immediately or at the end of the month. I hope that doesn’t come across as condescending, I just don’t want anyone to be in debt.

Membership Rewards Points

This will be the main reason to get the card. Membership Reward Points are the currency AmEx use for their points program. These points can be collected on all purchases and can be used for everything from Paying off your card bill or buying ice cream to booking first-class flights and hotels around the world.

First, we’ll take a look at how many points you’ll earn for buying things (known as earning rates)

- 1 point for every £1 spent on the card

- 2 points for every £1 spent directly with airlines

- 3 points for every £1 spent with AmEx travel (Their online travel website)

If you manage to spend £15,000 in a year, you’ll get an additional 10,000 points at the start of your next card year. This is handy for the big spenders out there, or those who spend then claim it back from their employer.

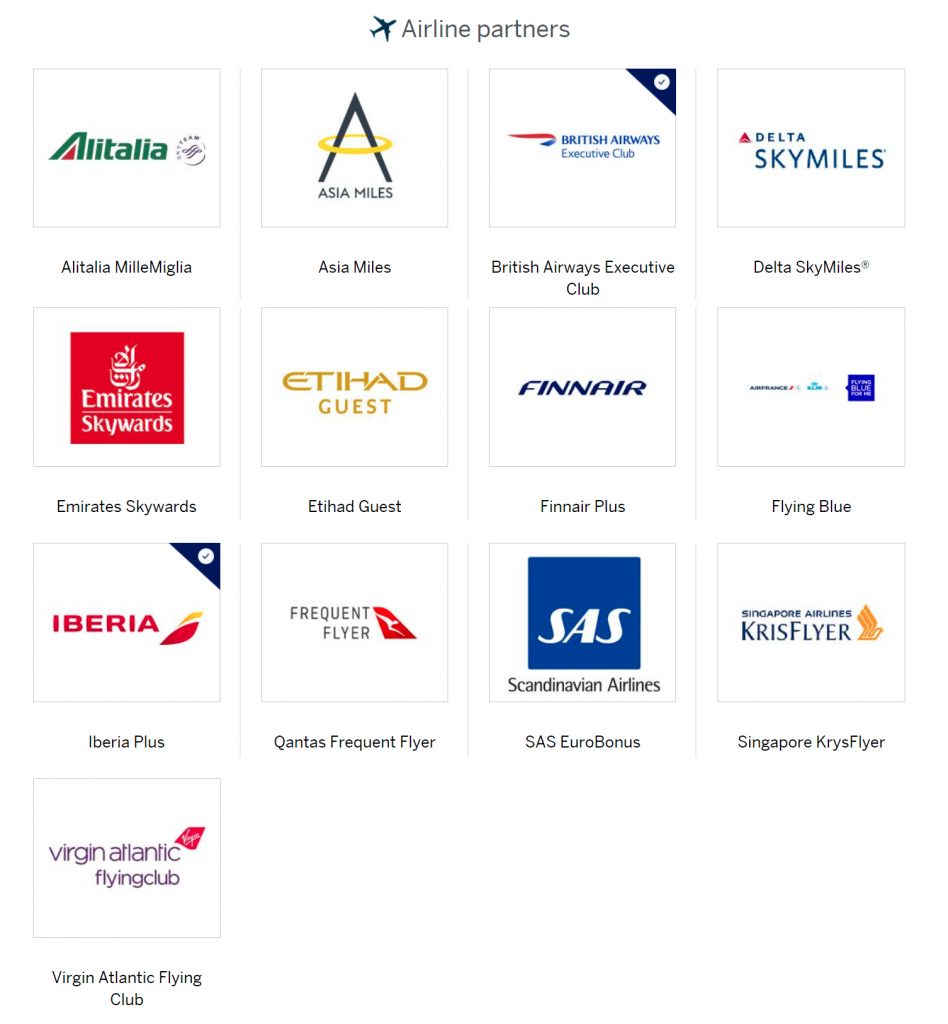

Now we’ll take a look at transfering points.

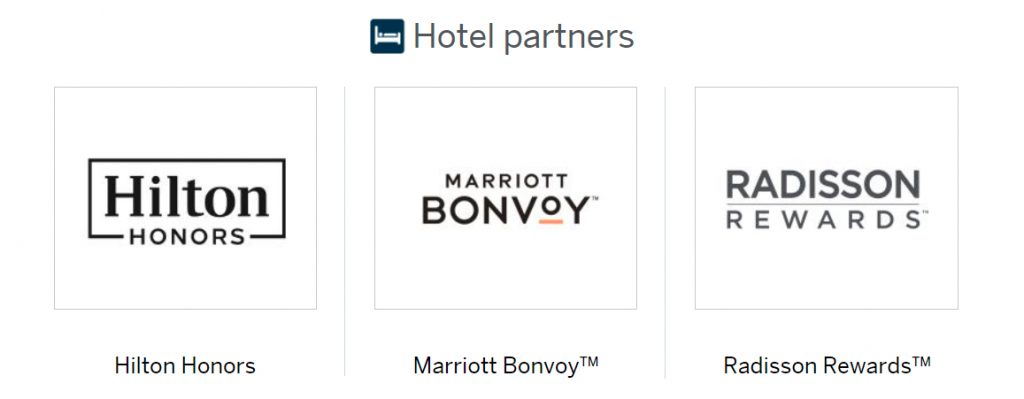

As you can see, AmEx has a whole sleuth of transfer partners. The general rule of thumb is 1 Membership Reward Point is equivalent to 1 Airline point. Things start to become a bit more complicated when you look at transferring to hotel partners where it can range from 1 MR point to 1.5 Marriot points through to 1 MR point being 3 Radisson points. Like with everything, not all points are equal.

My prefered usage for points is transferring to Virgin (When they have a promotion on offering a 30% bonus) to fly with ANA First Class where I can get about 11p per point of value. Failing that transferring to BA to use along with a companion voucher to go to places I don’t actually want to go but if it did it would cost a lot of money with cash so I go to create good value ?♂️ I aim for 10-15p per point with BA.

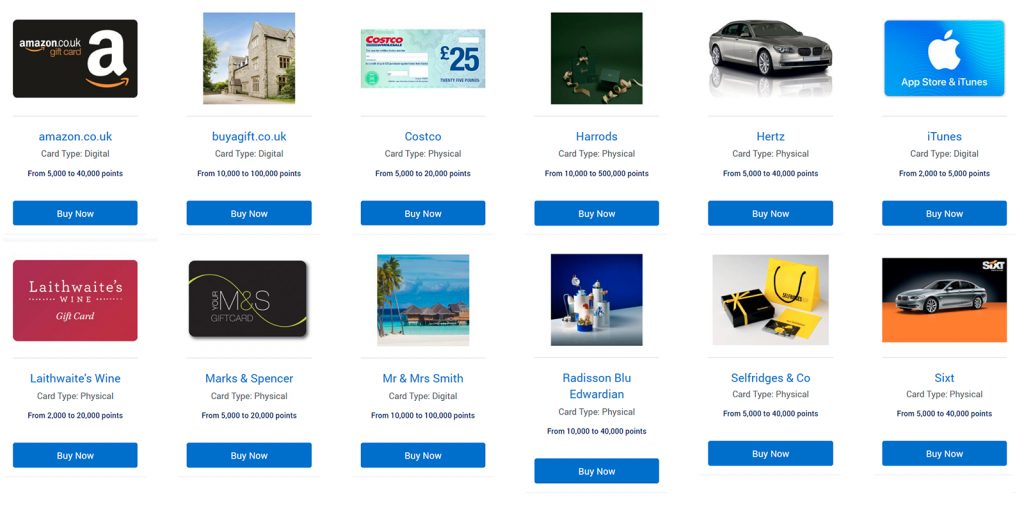

Finaly there’s spending points.

Be it on gift cards or just paying off your card balance. I strongly recommend against doing either of these. Gift cards you only get 0.5p of value per 1 MR Point and paying off your balance is even worse at 0.45p per 1MR Point.

Lounge Access

With your AmEx Gold card, you also get complimentary lounge access. It used to be through Lounge Club but recently AmEx moved to Priority Pass. You get 2 free passes every year you have membership.

These passes come in handy when you’re taking a flight with an airline you don’t have high enough status to grant access to a lounge; That or taking the edge off a RyanAir flight. Pictured above is the Valletta lounge at Malta Airport with an outside terrace overlooking the runway. As it’s 2 passes it can either be used for you and a companion once or 2 visits for yourself.

Offers

This is where AmEx come out swinging from time to time with incredible offers. Some of them are for weird companies you’d never buy anything from, then others are things like spending £500 at The Bath Store, get £200 back. Spend £200 at Marriott, get £80 back.

The ones I currently have saved to my card which are targetted to me based on my spending habbits are:

- Spend £400 at The May Fair hotel get £80 back

- Spend £300 at Radisson Blu Mercer Street get £60 back

- Spend £25 on a Telegraph Subscription get £20 Back

Another beauty that AmEx comes out with every now and again is Shop Small. Where they actively encourage you to forgo the chains and megastores and keep it small or local. The offer is usually to spend £10 or more in a single transaction and small shops and get £5 back up to 10 times. During a trip to London, I put it to the test and it worked grabbing a Mexican and some cocktails at Cafe Pacifico (The bill was £90~, £5 was deducted by AmEx). Grabbing 2 large icecreams at Udderlicious (£11, again £5 deducted by AmEx). Finally a meal at Kin + Deum Thai restaurant (£60, you guessed it…). All of which I can vouch provide amazing food and service.

Sign Up Bonus

This is where things get good in my opinion. AmEx offers a signup bonus of 20,000 MR Points when you spend £3,000 in the first 3 months. There are some people who read the blog that spend £3,000 in a single transaction and there are readers of the blog who would struggle to spend £3,000 in 3 months. I’m not here to judge anyone, I’m here to try and help both ends of the spectrum. If you’re the latter, you could always add someone to your account that you trust such as your other half, a parent or very close friend. That way their spending also helps you to get the spending target of £3k.

You won’t be eligible for the signup bonus if you have had any personal Platinum, Gold, Green or Rewards card with AmEx within the last 24 months. It used to be within 12 months so you could just keep cycling the signup bonuses then cancel, wait 12 months then do the same again. People like me used to sign up, add their other half and get the signup bonus done as quickly as possible. They then used to cancel the card and their other half would sign up and add them to the card and repeat. Then they would wait 12 months and do the same. Fair play to this kind of person, it was well within the rules to do so. Now that Amex makes you wait 24 months it has ruined that loophole which is a bit of a shame.

Good news is though, You can still have an AmEx Business Platinum, Gold or Green and still get the sign up bonus. The same applies if you have the BA Amex cards, Marriot cards, Amazon cards or Nectar card.

Cost

The first year is Gratis then it’s £140 a year after that. As it’s charged in advance at the end of year one you pay £140 for year 2. What you can do though, if you’ve spent £15,000 and you want your bonus 10,000 MR points, you can pay the £140 then cancell the card as soon as those points clear. In doing so you get a pro rata refund meaning you’ll maybe pay £1-£3.

Foreign transactions also incur a 3% fee, you do get 2 points per £1 spent on foreign purchases but the whole 3% fee far outways this.

My Take

I like the AmEx Gold card a lot. I’m a high spender and churn through points be it on personal or work expenditure. The ability to transfer points to a whole host of programs along with the offers the keep popping up are what keep the card in 1 of only 5 slots in my wallet. I have to make it as clear as possible, AmEx is world-renowned for their customer service, introduce a pandemic though and they have absolutely shit the bed! I’m owed a good 5 figures in flight booking refunds, it wouldn’t surprise me if I had supplied over 100 documents as evidence for chargebacks. They have all failed and AmEx says i am liable, this is even the case when I have written documentation from airlines stating I am entitled to a full refund…

The long and short of it is, AmEx has no competition in the UK, nobody even comes close. If that means i have to deal with piss poor service, so be it.

Referal

If you’re reading it and want to take the plunge, drop me a message and i’ll send a referal link where you’ll get an extra 10% on the signup bonus.