I’ll preface this whole post and most other post’s I write by saying, I love a bargain and I love to find loopholes.

Throw it back to 2018 when I’d had the BA AmEx Premium card for just under a year (earning the 2-4-1 voucher for BA flights after spending £10k). Now it was time to refer myself to get the AmEx Gold Card where I’d receive a bonus of 9,000 Avios on the BA card for the referral and a signup bonus of 20,000 Membership Rewards Points for spending £3,000 in the first 3 months.

I’ve always been fascinated with AmEx, where it be the stories you hear about BIG purchases at Christie’s being paid for with AmEx or this one story I read about a guy who had their Centurion Card, who had proposed to his other half on their yacht. He had totally overlooked having flowers for her as a celebration (Turns out proposing with a ring isn’t enough nowadays). Anyway, he gets on the blower to AmEx’s concierge team and gets them to organise flying out some flowers on a seaplane… AmEx just has an allure to it I can’t shake.

Digression aside, I decided to buy a house using my AmEx Gold Card. The thought process went something along the lines of “Over 25 years you end up paying an extra 40% on interest, I wonder if I can buy one with my AmEx, Imagine the points you’d get.” After ringing AmEx they told me that they wouldn’t allow me to load my card up. That means if you had a £1k credit limit, that would be it £1k. You couldn’t transfer another £1k so that you could make a £2k purchase. To get around this I had to also use my AmEx BA Premium Card as well.

All in I got 90,000~ AmEx MR Points and 185,000~ Avios and a 2-4-1 voucher to use on BA.

The booking process

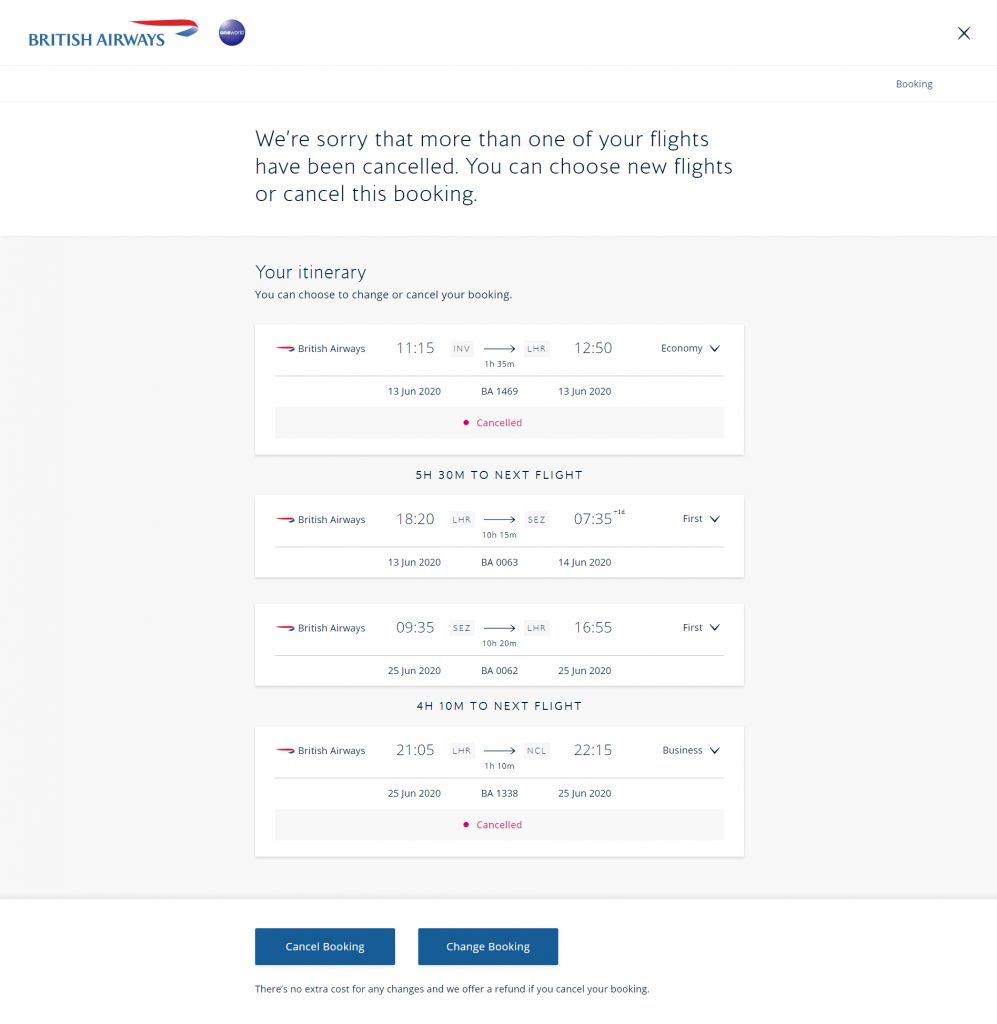

Originally we had Seychelles booked for almost a month in May 2020 in Business Class. British Airways only guarantee to release 2 Business Class seats. Yes, they release First class too, but it isn’t a guarantee as we found out calling up at midnight to try and snag the 2 first-class tickets before anyone else only to find out that for these specific flights they only released business. On the plus side though, we decided to start our journey in Inverness meaning we would save £145 each by not having to pay Air Passenger Duty.

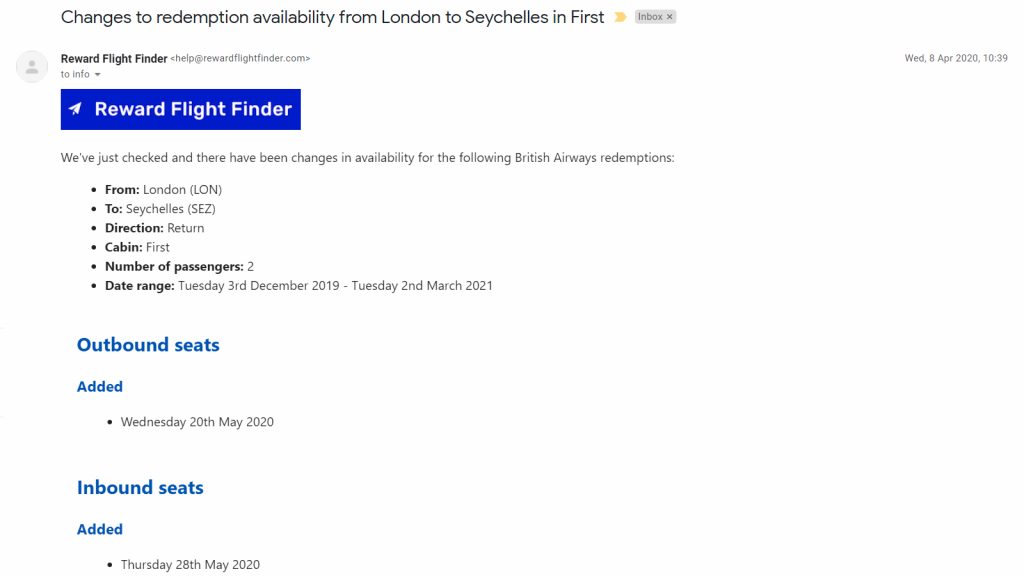

Using Reward Flight Finder a notification request was set up so that any flights to or from Seychelles that had First Class availability using Avios, we would receive an email. With a ping in the inbox and a quick call to BA, our tickets were swapped out to First Class. The plan was to spend almost a month out there with 1 week allocated to playing golf, 1 week dedicated to exploring, and the other 2 weeks just relaxing. As we wanted to fly First though we had to settle for a week.

Unfortunately with everything that went on to happen, our Seychelles trip got cancelled and BA eventually ended up pulling the plug on flying to Seychelles for good. The good news in some senses as I really didn’t want to pay £2,500 to quarantine in a shoddy hotel when we got back. Not to worry though, because it was BA that cancelled we were able to change our routes to the same zone (Under 5,500 miles).

Flights to The Maldives

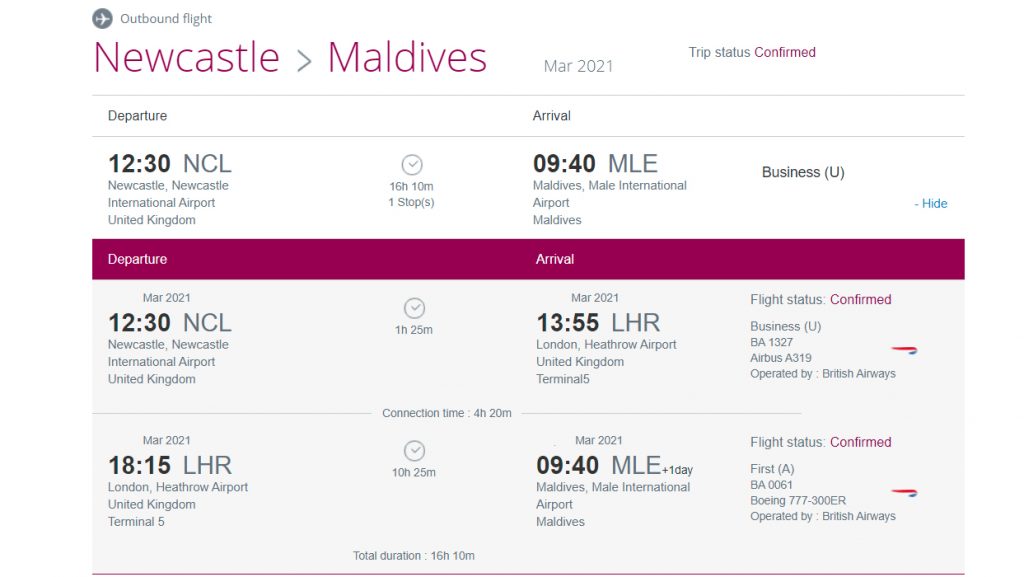

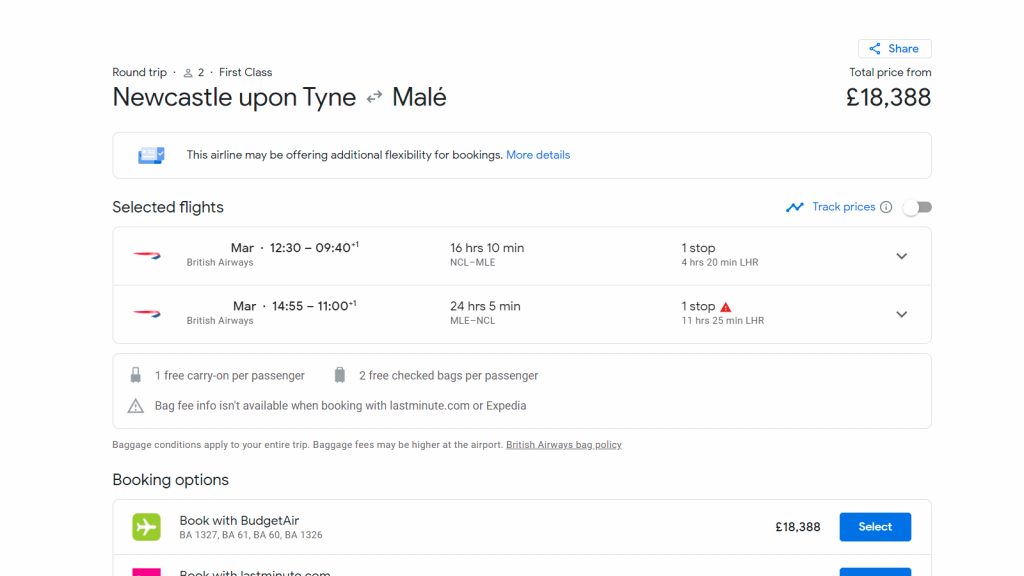

We had to settle for the Maldives. The good news is that we were also allowed to change the departing airport at no cost. We naturally chose Newcastle as it’s our local and as nice as the drive is up to Inverness and the parking is free, it saved us a 6-hour drive. That’s our flights as it stands now then. Newcastle to the Maldives in First Class.

Booked as a cash ticket it would run you a smooth £9,000+ EACH (Seychelles in First used to be £11,000 each so were missing out on a good £4,000 worth of value).

The actual cost

170,000 Avios, a 2-4-1 voucher and £1080 is what it cost to book 2 of us all in. In terms of value, by the time you take off the £1080 for the Taxes and BA’s overpriced surcharges along with the £195 for the BA AmEx card it works out at £17,113 for 170,000 Avios. Just over 10p per avios!

The Hotel

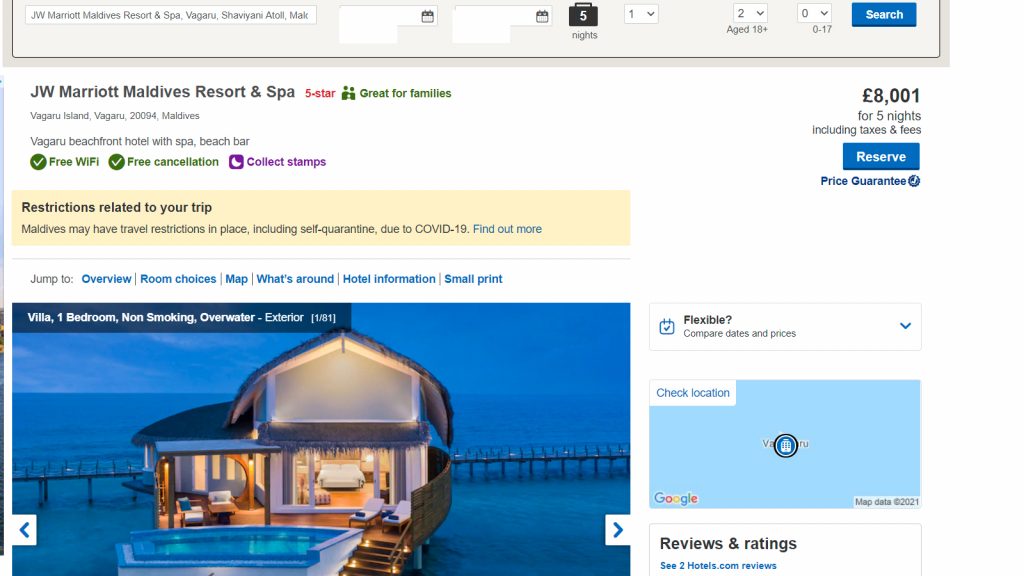

Now onto the hotel, Again I didn’t really want to go to the Maldives, it’s just nowhere else is open. If it’s the Maldives, it has to be an overwater villa. I had looked at booking the Conrad as I have had amazing stays with them before at other locations. From all the reviews I read the food isn’t supposed to be very good and when you’ll be paying at least £400 a day on it, you at least want it to be nice.

Turning to Marriott and both their W Maldives and JW Marriott gives you the option to book overwater villas using points. JW Marriott is slightly more expensive for the seaplane as its a much longer journey but it also has a much more high end feel to it than the flamboyant W brand.

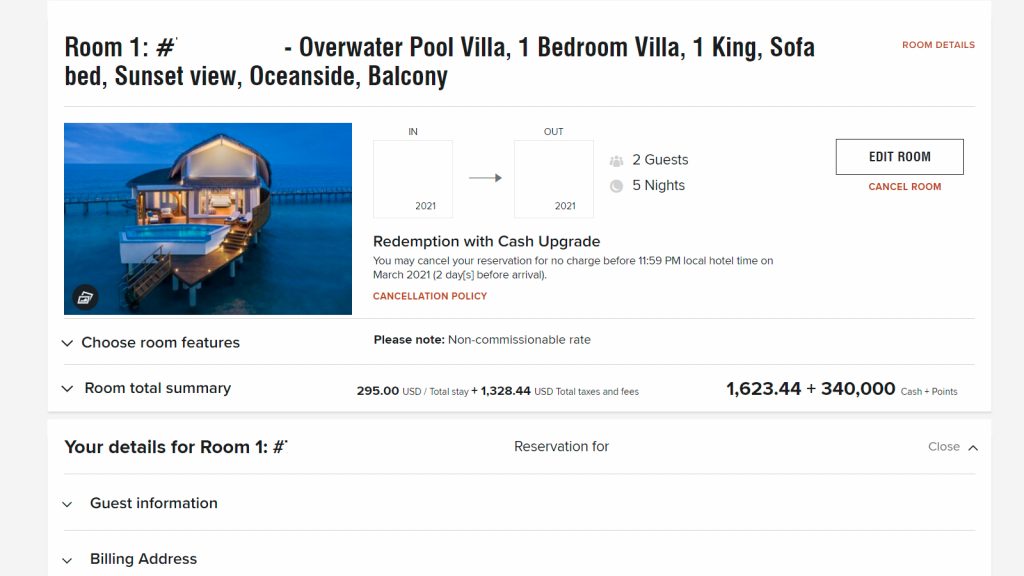

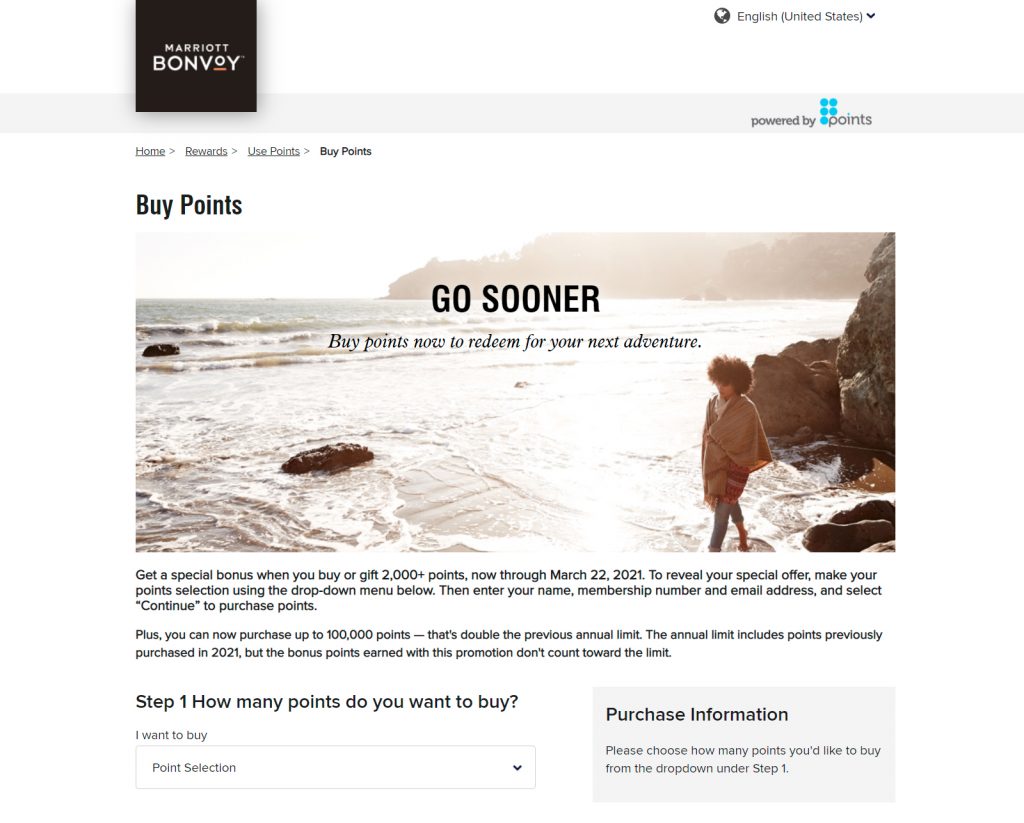

As I wrote about recently, Marriott has a sale on buying their points. As I had 93,000 AmEx MR points, that only transfers to 140,000 Marriott Bonvoy points. I had to buy the other 200,000 Marriott Bonvoy points at a cost of £1580.

The total cost for the hotel

£2744 was the total cost for 5 nights at the JW Marriott in an overwater bungalow. That inclused the ludacrous cost of £1164 for the seaplane transfer for 2 people.

The same 5 nights booked for cash would run you £8,000. Take away the £1164 for the seaplane and youre getting £6836 worth of vaue from £1580 worth of points that were purchased and the other 140,000 points that were transfered. That works out at 1.5p of value per point.

Flights and hotel total cost

For 5 nights we had booked in The Maldives it would cost you £26,000 if you were to pay with cash. Using points it cost us a total of £3822, which isn’t cheap at all especially when you don’t actually want to go to The Maldives. However it represents exremely good value.

The 30th that never was…

Even though we were clearly going to look at purchasing a property in The Maldives and as such would have been allowed to fly, I’ve drawn my line in the sand at one specific charge which has caused me to cancel it all.

I’d accepted the fact that we would both need COVID tests before we flew to the Maldives, That’ll be anywhere from £75-100 each. I’d also accepted the fact we would need one before we flew back to the UK, again I factored about £150 each for tests in the Maldives. The nail in the coffin though, The compulsory £210 per person for 2 tests when you land back in the UK. No choice of using 3rd party providers or anything, you just have to pay an inflated price to Boris’ mates. £870 or thereabout on COVID tests which I would happily swallow up if I knew I wasn’t getting shafted, not a chance though.

Another thing though, having just typed it, £870 goes a long way when you’re a thrifty traveller, That’s like flights and hotel for 5 nights in New York. Frustrating really as last year I had planned 5 local Michelin Star restaurants for 7 stars in 7 days.

Moral of the story

You don’t have to have an AmEx Centurion card to buy a house, you can use any AmEx and you’ll acquire a good few points. Just make sure you pay it off straight away, I reckon the interest payments wouldn’t be too pleasant.

When an airline cancels your flight, you have a hell of a lot of adjustabilities.

There are times when buying points gives amazing value.

The Maldives are expensive…

12 months in, the UK Government still hasn’t a clue whats it’s doing in regards to COVID.